As announced in the Budget Statement 2021, additional support will be provided to ease the transition to higher petrol excise duties for those who rely on their vehicles for their livelihoods. Active drivers of petrol and petrol-hybrid taxis and private hire cars (PHCs), and individual owners of smaller motorcycles, will receive additional Petrol Duty Rebates (PDRs), on top of the respective road tax rebates for cars and motorcycles. The additional PDRs will be disbursed from May 2021.

2 The total amount of rebates for taxis/PHCs and motorcycles are as shown in the table below. Taken together, the road tax rebates and the additional PDRs will offset the increase in petrol duties for about one year for eligible taxi and PHC drivers, and individual owners of smaller motorcycles.

Type of Vehicle Using Petrol |

Amount of Rebates |

Taxis/PHCs |

15% road tax rebate for one year; and additional PDR of $360 disbursed over four consecutive months for active drivers |

Motorcycles |

60% road tax rebate for one year; and additional PDR of $80 for individual owners of motorcycles registered as at the close of 16 February 2021 with engine capacity of 200cc and below, and $50 for individual owners of motorcycles registered as at the close of 16 February 2021 with engine capacity of 201 – 400cc[1] |

Taxis and PHCs

3 The Land Transport Authority has worked closely with the taxi and PHC operators, the National Taxi Association and the National Private Hire Vehicles Association to facilitate the disbursement of the rebates to taxi and PHC drivers.

4 Road tax rebates. Taxi operators have committed to fully pass on the 15% road tax rebates to their main hirers who are driving petrol and petrol-hybrid taxis. This will be provided through rental rebates between mid-March and April 2021. For PHCs, GrabRentals and some of Grab’s recommended fleet partners have committed to passing on the road tax rebates to drivers who lease petrol and petrol-hybrid PHCs from them. Gojek has committed to introducing additional incentive rebates for their drivers in March and April 2021. We urge all vehicle lessors to pass on the road tax rebates to their lessees, who are incurring the higher petrol costs.

5 Additional PDR. LTA will disburse the additional PDR to all active drivers of petrol and petrol-hybrid taxis and PHCs through the taxi and PHC operators over a period of four months, from May to August 2021. No application is required, and all drivers (both main hirers and relief taxi drivers and PHC drivers) who meet the following criteria will automatically qualify for the PDR and will be notified by their operators:

- Drivers of petrol and petrol-hybrid taxis and PHCs; and

- Drivers who are eligible for the COVID-19 Driver Relief Fund or drivers who completed an average of at least 200 trips per month between January 2021 and April 2021.

Motorcycles of up to 400cc

6 Road tax rebates. All motorcycle owners will receive 60% road tax rebate for one year from 1 August 2021 to 31 July 2022. We urge owners who are leasing out their motorcycles to pass on the rebates to their lessees, who are incurring higher petrol costs.

7 Additional PDR. Individual owners of petrol and petrol-hybrid motorcycles with engine capacity of up to 400cc will also be eligible for the additional PDR. LTA will disburse the additional PDR in cash progressively from mid-May, through GIRO or PayNow (NRIC). No application is required. Owners will be notified via SMS when the additional PDR has been credited to their bank accounts.

8 The PDR will be paid to all eligible individual owners of motorcycles registered as at the close of 16 February 2021. Individual owners with more than one motorcycle will receive road tax rebates for each motorcycle, but only one payout of the additional PDR based on the higher quantum among the eligible motorcycles.

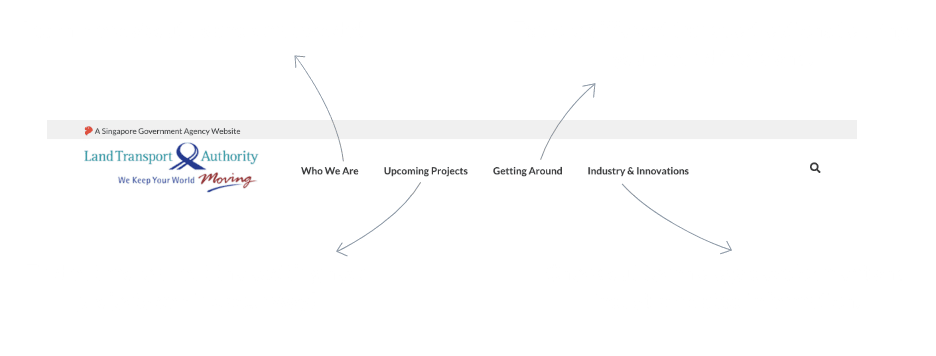

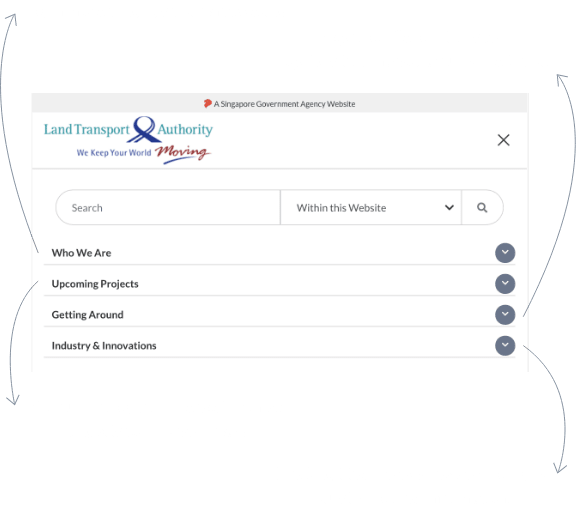

9 Individual motorcycle owners who wish to receive the additional PDR via GIRO should ensure that they update their bank account details on LTA’s website at go.gov.sg/ltaupdate (or via the attached QR code) by 15 May 2021.