The Measures Support the Singapore Green Plan Vision for All New Car and

Taxi Registrations to be of Cleaner Energy Models from 2030

To continue encouraging the purchase of cleaner car models, the enhanced Vehicular Emissions Scheme (VES) will be extended for three years to 31 December 2025. Tightened pollutant thresholds will be introduced from 1 January 2024.

Vehicular Emissions Scheme (VES)

2. The VES is an outcome-based feebate scheme to encourage the purchase of cleaner cars with lower emissions[1] of carbon dioxide, hydrocarbons, carbon monoxide, nitrogen oxides and particulate matter. Under VES, buyers of new cars enjoy a rebate off the Additional Registration Fee (ARF), subject to a minimum ARF payable of $5,000[2], or pay a surcharge depending on the VES band of the car model.

Tightened pollutant thresholds to make clearer distinction between pure internal combustion engine (ICE) cars and cleaner cars

3. Tightened pollutant thresholds for the enhanced VES will be introduced from 1 January 2024 to 31 December 2025. The more stringent thresholds for emissions of carbon dioxide, hydrocarbons, carbon monoxide, nitrogen oxides and particulate matter (as detailed in Annex A) clearly distinguish pure ICE cars, cleaner alternatives such as hybrids and Electric Vehicles (EVs). Only cars with zero tailpipe emissions (e.g., EVs) will qualify for Band A1 while Band A2 will include EVs with high power consumption, most hybrids, and some pure ICE cars that are smaller and more efficient. Other pure ICE cars and some hybrids will fall under the other bands. More details on the types of cars and examples of car models in each band can be found in Annex B.

4. There will be no change to the VES rebate till 31 December 2023 and no change to the VES surcharge till 31 December 2025 (as detailed in Annex C). The applicable VES rebates from 1 January 2024 will be announced in 2023.

Impact on the motoring industry and car buyers

5. In 2021, the National Environment Agency (NEA) consulted the motoring industry on the tightened pollutant thresholds for the VES. Most motor dealers had no objections to the revisions, and the implementation timeline was extended to allow a longer lead time for the import of cleaner vehicle models, given the tightened thresholds. For car buyers, there will still be a variety of models across the rebate and neutral bands, as shown in Annex C.

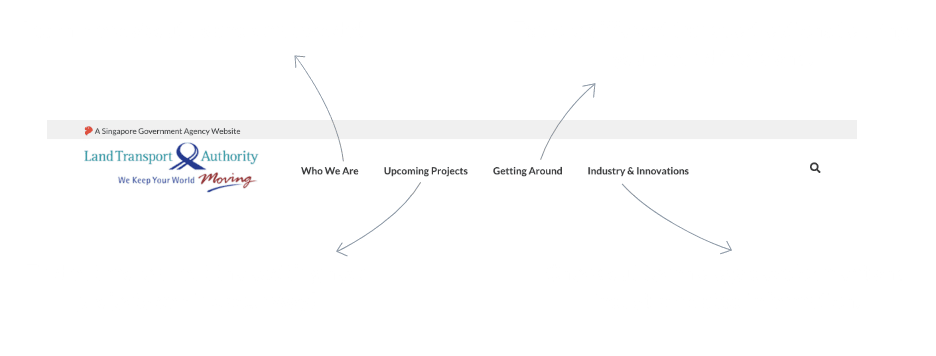

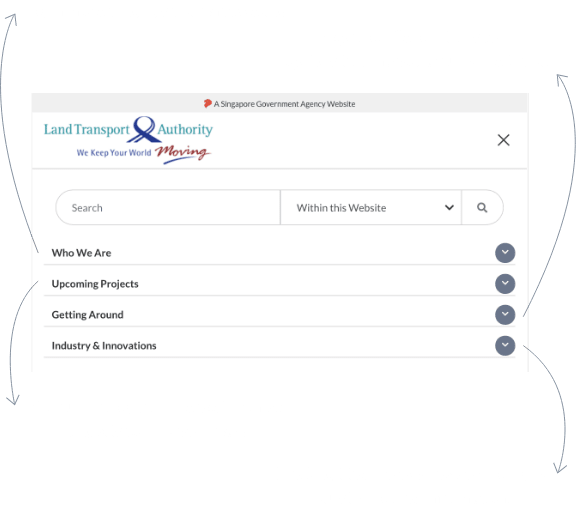

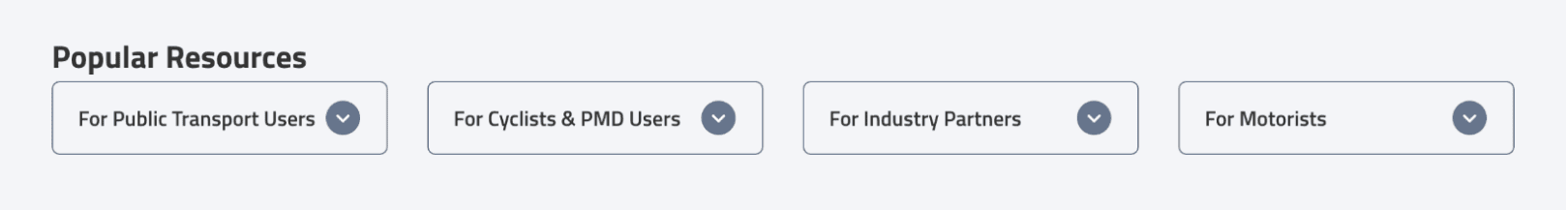

6. More information on the VES can be found at: https://onemotoring.lta.gov.sg/content/onemotoring/home/buying/upfront-vehicle-costs/emissions-charges.html. Buyers and motor dealers may contact NEA via our Online Feedback Form at www.nea.gov.sg/feedback or the myENV mobile application, for enquiries on the VES.